Community resources

Community resources

Community resources

Risk Management: The Crucial Role of Legal Counsel

Organizations worldwide have encountered various emerging challenges in recent years, fundamentally altering the traditional approach to business operations. These challenges include the complexities of data management, the ever-present threat of cybersecurity breaches, political upheaval, and a growing demand for social accountability. Such factors have made fundamental business decisions increasingly complex, calling for a more sophisticated approach to risk management.

Central to addressing these new challenges is the expanded role of risk managers. Today, they are not just tasked with identifying potential hazards but also expected to leverage their cross-departmental connections and expertise to craft effective organizational responses. This evolution marks a significant shift from their traditional roles, positioning them as integral players in navigating these complex landscapes.

Another critical development is the increased involvement of legal authorities within organizations. Roles such as general counsel and chief legal officer have transcended their conventional boundaries, now addressing a broader spectrum of risks that straddle legal and business domains. This change underscores the need for a more integrated approach to managing business and legal risks.

A 2021 ACC CLO survey showed that most organizations believe risk management has become a collective endeavor, with various departments working in concert to mitigate risks, including legal, finance, and others. This collaborative approach is essential for developing the kind of comprehensive risk management strategy that modern businesses increasingly expect.

In many instances, effective risk assessment and mitigation hinge on the close collaboration between risk management and legal teams. The CLO survey suggests critical areas for cooperation include industry regulations, data privacy, political shifts, and mergers and acquisitions. The legal department is also crucial when developing compliance strategies, incident response plans, and continuity plans.

Moreover, today's global business environment demands a keen understanding of political and cultural sensitivities. Addressing the legal and reputational risks associated with these factors requires coordinated efforts between the risk and legal departments, ensuring that the organization's actions align with its values and the expectations of its stakeholders.

The evolving role of risk professionals, in collaboration with legal teams, is crucial in today's complex business environment. Their combined expertise in managing emerging threats and sensitivities is key to safeguarding the organization in a dynamic global market.

Risk Register by ProjectBalm

Dealing with the emerging risk landscape is much easier when you have an appropriate tool. This is one reason we created Risk Register by ProjectBalm.

Our goal was to automate best practice risk management techniques, and do so via an elegant, usable interface that works with you, and not against you. Risk Register will help you to identify, analyse, treat and monitor risks more easily and effectively than ever before.

If you are experienced at risk management, you will find in Risk Register a tool that works the way you want it to work. If you are new to risk management, our documentation and videos will take you through the whole risk management process, giving lots of useful examples.

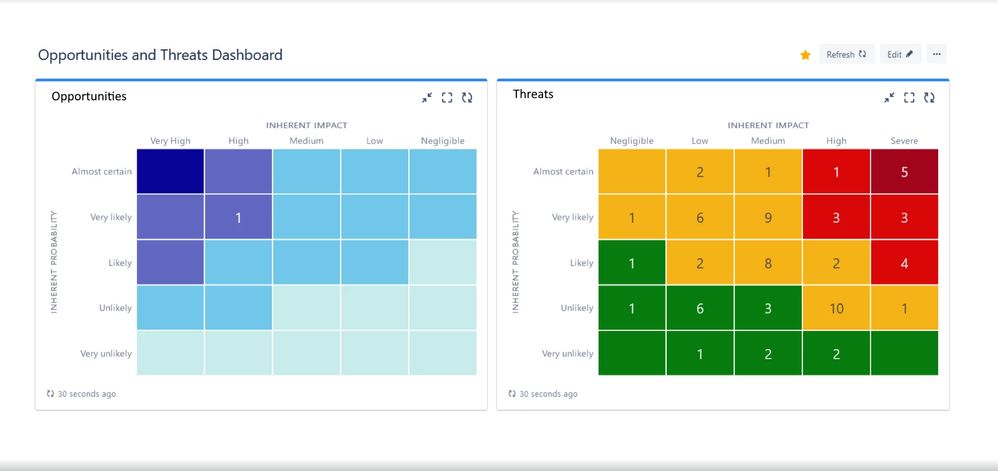

Risk Register is fully compatible with risk management standards such as ISO 31000, and can also be used for governance, risk, and compliance (GRC) programs such as Sarbanes-Oxley and PCI. And, of course, Risk Register allows you to easily distinguish between opportunities and threats.

Over the last few years, we've grown to become the most popular risk management solution in the Jira marketplace and we are now an Atlassian Platinum Partner. Why not try out Risk Register by ProjectBalm for yourself?

Was this helpful?

Thanks!

Craig Schwarze _ProjectBalm_

About this author

Founder at ProjectBalm

ProjectBalm

Sydney

8 accepted answers

Atlassian Community Events

- FAQ

- Community Guidelines

- About

- Privacy policy

- Notice at Collection

- Terms of use

- © 2024 Atlassian

0 comments