Community resources

Community resources

Community resources

SLAs in Action: How Different Industries Use Jira for Reliability

We’re starting a series of articles about how SLAs can be implemented to optimize and improve processes in industries where, at first glance, SLAs may not even seem relevant. Our goal is to dispel that myth and show how companies across different fields – from fintech to healthcare, education, and retail – use SLA management in Jira to gain control, efficiency, and trust.

So, let’s begin the first part of the series

SLAs in Fintech: Every Minute Counts

Many teams still think SLAs are only for IT support, but in reality, fintech, healthcare, retail, and even public sector teams rely on them every day.

In this first article, we’ll look at fintech, where every minute matters and SLA automation in Jira helps prevent losses, ensure compliance, and build customer trust.

In fintech, a delayed response can mean lost money, broken trust, or compliance penalties. That’s why SLAs here are measured not in days but in minutes. With Jira and SLA Time and Report, teams can set strict timers, automate escalation, and prove compliance in audits.

Why Fintech Needs Ultra-Fast SLAs

Claim: SLAs in fintech are about speed and control.

Why: Customers expect instant availability, while regulators demand strict reporting.

Evidence:

- Fraud incident SLA: Time to Resolution ≤ 30 minutes.

- High-priority service outage: First Response ≤ 10 minutes.

- Compliance report delivery: Resolution ≤ 24 hours.

These aren’t just targets – they’re survival requirements.

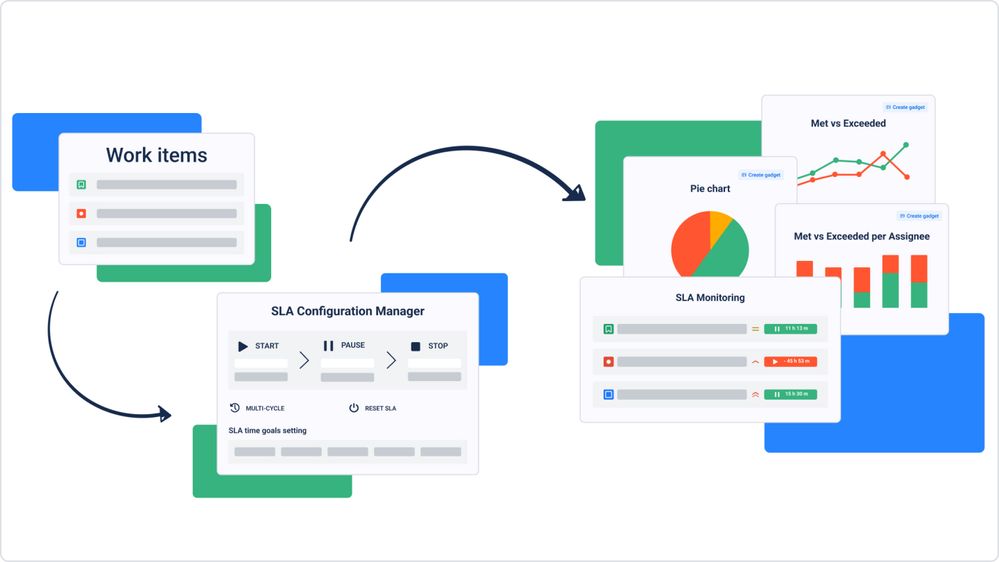

How SLA Time and Report for Jira Helps

- Custom SLA goals: Define timers per priority, work item type, or compliance need (e.g., fraud, transaction errors, API downtime).

- Real-time tracking: SLA panel in each ticket shows time left and time spent. Nothing slips unnoticed.

- Automation triggers: When an SLA is close to breach, automatically reassign to senior staff, change priority, or notify stakeholders.

- Multi-project reporting: See SLA compliance across multiple services (e.g., payments, KYC, support).

- Executive dashboards: Met vs Exceeded charts prove where the team consistently beats SLAs – great for regulator or board reports.

🛠 Example: A fintech support team sets a 30-minute SLA for payment disruptions. SLA Time and Report automatically escalates unresolved tickets after 20 minutes, ensuring leadership sees work items before customers feel the pain.

Turning Data Into Advantage

Fintech teams don’t just avoid breaches – they show where they exceed SLAs. SLA Time and Report provides visual charts:

- Met vs Exceeded Chart: See compliance plus extra-fast cases.

- Criteria-based Charts: Break down SLA results by assignee, service, or severity.

This not only secures compliance but also builds customer trust: “We solved 85% of outages under 20 minutes.”

Curious About Other Industries?

Fintech is just the first stop in our journey. SLAs play a critical role in many other areas too – from healthcare (where response times impact patient safety), to IT and software (where predictability drives delivery), to education and public services (where accountability and transparency matter most). Even retail and e-commerce teams rely on SLA reporting to keep promises during peak demand.

👉 Which industry are you most curious about? Share in the comments, and we’ll dive into it in the upcoming parts of this series. Next up: Healthcare – where compliance and care meet SLA tracking.

FAQ

- What is time to SLA?

It’s the countdown until the SLA goal is breached. Example: a fraud incident must be resolved in ≤30 minutes. - Can I automate SLA escalations in Jira?

Yes. With SLA Time and Report, you can auto-reassign, change status, or notify stakeholders before breach. - How does SLA reporting help fintech audits?

SLA reporting creates a transparent record of how quickly work items were handled. Dashboards and charts show, for example, how many fraud alerts were resolved within 30 minutes or how many payment incidents breached the SLA. For fintech audits, this acts as proof that the team consistently meets regulatory and contractual obligations – without manually pulling data. - Can I use different SLAs for different transaction types?

Yes. In Jira with SLA Time and Report, you can configure separate SLA goals for different categories. For example, a failed payment might require a 30-minute resolution, while a KYC verification delay might allow 24 hours. You can set these conditions using work item type, service field, or custom fields so each transaction type has its own timer and reporting. - How do I track SLA data inside a Jira ticket?

Each Jira work item includes an SLA panel when you use SLA Time and Report. This panel shows all the active timers. You don’t need to build anything manually – once SLAs are configured in the app, the panel appears automatically in every relevant ticket. - Does it support multiple projects?

Yes, you can track SLAs across all fintech services and report them together. - What’s the advantage of Met vs Exceeded charts?

Standard reports only show whether you hit the SLA or missed it. Met vs Exceeded charts go further: they also reveal where your team closed work items faster than required. For example, you might see that 60% of security incidents were resolved in under 20 minutes even though the SLA target was 30 minutes. This helps demonstrate not just compliance but also exceptional performance. - Can SLA Time and Report help with regulator compliance?

Yes. Reports can be exported and used as proof for compliance checks and board-level reviews.

⚡ Takeaway: In fintech, SLAs are the difference between trust and risk. With Jira and SLA Time and Report, you can measure every minute, automate response, and prove compliance – without drowning in manual work.

😷 Read part 2 here: SLAs in Healthcare: Timeliness Meets Patient Safety

🔐 Part 3 here: Cybersecurity and MSP Reliability

💻 Part 4: IT & Software Development

🏛️ Part 5: Public Sector & Education

🛒 Part 6: SLAs in E-commerce & Retail

Was this helpful?

Thanks!

Alina Kurinna _SaaSJet_

0 comments