Community resources

Community resources

Community resources

- Community

- Products

- Apps & Integrations

- Questions

- Risk Management: What Does it Cost?

Risk Management: What Does it Cost?

Most modern businesses recognize that risk management is essential, but fewer are willing to acknowledge it is inherently costly. There is a common misconception that you can implement effective risk management with minimal financial outlay, but this is far from the truth. There are several significant costs involved.

Establishment Costs

Before an organization can effectively manage risk, it must establish a solid foundation. There are several significant costs.

Developing Methods and Procedures: This involves the formulation of structured processes for identifying, assessing, and monitoring risks. It includes costs such as:

- Researching industry best practices.

- Document drafting and reviews.

- Pilot testing new procedures.

- Continuous refinement based on feedback.

Consultation and Expertise: Engaging with risk management experts, consultants, or specialized firms to bring in external insights and knowledge.

- Fees for professional consultancy.

- Costs related to workshops or training sessions they might conduct.

Acquisition of Tools and Technology: Investing in state-of-the-art risk management software, platforms, or tools that aid in the systematic handling of risks.

- Software licensing or subscription fees.

- Hardware and other infrastructure costs.

- Maintenance and update costs.

Training and Development: Ensuring the organization's staff is well-versed with the new methods and tools.

- Creation of training modules or materials.

- Hiring trainers or facilitators.

- Organizing training sessions, workshops, or seminars.

Policy Formulation and Documentation: Drafting official risk management policies, guidelines, and related documentation.

- Costs for legal reviews to ensure compliance.

- Printing, distribution, or digital archiving costs.

Communication and Awareness: Making stakeholders, both internal and external, aware of the new risk management practices.

- Costs for communication campaigns.

- Informational sessions or town hall meetings.

Regulatory Compliance and Certifications: If applicable, ensuring that all procedures are in line with industry regulations.

- Compliance audit fees.

- Certification or licensing fees.

If the organization under-invests in these areas, the risk management process will likely be compromised before it begins.

Ongoing Costs

Risk management isn't a set-it-and-forget-it affair. There are several ongoing costs.

Audits and Compliance Checks: Regularly evaluating the organization's adherence to established risk management procedures is vital. This includes:

- Hiring external auditors or allocating resources for an internal audit team.

- Investing in audit tools or platforms that assist in compliance checks.

- Corrective actions or modifications post-audit findings.

- Documentation and reporting costs related to these audits.

Subscription to Tools and Information Sources: As risk landscapes evolve, staying updated is crucial.

- Annual or monthly subscription fees for risk management software or platforms.

- Subscriptions to industry journals, reports, or databases that provide insights into emerging risks.

- Fees for attending webinars, seminars, or conferences on risk management.

Training and Development:

- On-board training for new staff to familiarize them with the organization's risk management processes.

- Periodic refresher courses or workshops for existing staff.

- Costs for developing or updating training materials.

- Fees for external trainers or facilitators, if engaged.

Process Evolution: Adapting to the changing risk environment is essential.

- Research costs to study new methodologies or approaches in risk management.

- Expenses related to integrating new processes or tools.

- Time costs associated with reviewing and revising existing procedures.

Communication and Stakeholder Engagement: Ensuring that all stakeholders are informed about any changes or updates in the risk management approach.

- Costs associated with organizing informational sessions or meetings.

- Expenses related to producing and distributing communication materials.

This ongoing investment ensures the risk management process remains contemporary, relevant, and effective.

Project-specific Costs

Once the risk management process is established and maintained, the organisation must apply it to each project, which comes with bespoke costs. These encompass two broad areas:

Risk Analysis: The identification, assessment, and treatment of all significant risks associated with the project.

-

Identification workshops, which require expert facilitators, logistical arrangements, and the allocation of project team time.

-

Mitigation strategy meetings, involving stakeholders and experts, potential research expenses to inform decisions, and the cost of recording and distributing the agreed-upon strategies.

-

Risk retrospectives to evaluate the triggered risks their subsequent impacts. The expenses here are primarily the commitment of project team time.

-

Expenses related to the creation and distribution of required risk reports.

Risk Response: The execution of mitigation plans once a risk is triggered.

- Financial investments necessary to implement the measures outlined in the mitigation plans. This could include costs for additional resources, technology, or other corrective measures.

- Team hours dedicated to the execution, monitoring, and refinement of these plans.

- Potential expenses for external support, such as consultants, legal counsel, or specialized services, depending on the nature of the risk.

- Costs for post-incident analysis and reporting, capturing lessons learned, and refining future risk response strategies.

Organizations must factor these costs into the project budget, or the risk management process will likely be impaired. Forgoing this investment exposes the organization to unmanaged risks, potentially leading to adverse project outcomes and missed opportunities.

A tangible way to understand the ramifications of inadequate risk management is by examining the organization's past project budget and schedule blowouts. Historical data often reveals the cost implications of unmanaged risk. The conclusion is clear: any organization that wishes to manage risk effectively must be willing to pay the associated costs.

Risk Register by ProjectBalm

Professional risk management requires a cost-effective tool. This is one reason we created Risk Register by ProjectBalm.

Our goal was to automate best practice risk management techniques, and do so via an elegant, usable interface that works with you, and not against you. Risk Register will help you to identify, analyse, treat and monitor risks more easily and effectively than ever before.

If you are experienced at risk management, you will find in Risk Register a tool that works the way you want it to work. If you are new to risk management, our documentation and videos will take you through the whole risk management process, giving lots of useful examples.

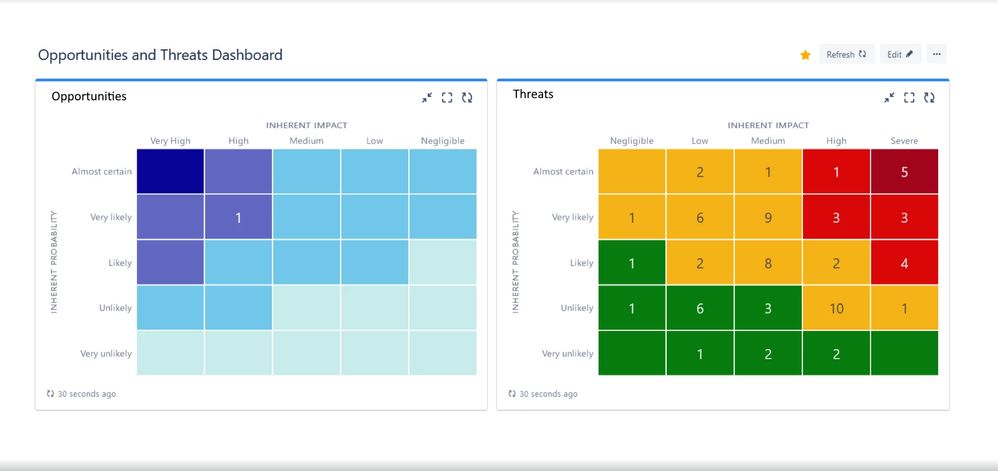

Risk Register is fully compatible with risk management standards such as ISO 31000, and can also be used for governance, risk, and compliance (GRC) programs such as Sarbanes-Oxley and PCI. And, of course, Risk Register allows you to easily distinguish between opportunities and threats.

Over the last few years, we've grown to become the most popular risk management solution in the Jira marketplace and we are now an Atlassian Platinum Partner. Why not try out Risk Register by ProjectBalm for yourself?

0 answers

- FAQ

- Community Guidelines

- About

- Privacy policy

- Notice at Collection

- Terms of use

- © 2024 Atlassian