Community resources

Community resources

Community resources

Risk Management: A Beacon in the Financial Storm

In today's global environment, we are entangled in a financial crisis marked by damaging inflation and a powerful credit squeeze, affecting businesses and consumers alike. As seen in several high-profile bank failures, not even our venerable banking industry has been spared. Amidst this chaos, political leaders struggle to wield a positive influence and appear to be mere observers of the unfolding turmoil.

This scenario has triggered some debate around the role of risk management. Detractors have been quick to cast blame, asserting that a deficiency in risk management has been a significant driver of the current financial distress. Consequently, the role of risk management as a protective shield for businesses against loss has come under scrutiny.

Some argue that given the capricious nature of risks, proactive risk management is unnecessary and unaffordable in times of crisis. Critics suggest businesses should instead concentrate their resources on strengthening their core operations. Given the current state of affairs, they say, business does not have the capacity to indulge in risk management.

However, this viewpoint fails to recognize the inherent benefits of risk management. Risk management acts as an organization's compass, guiding its journey through unpredictable terrains. By offering early detection of potential threats and opportunities, it enables contingency planning, bolstering the organization's adaptability and resilience. Moreover, risk management plays a pivotal role in identifying actions that reduce wastage, enhance productivity, and bolster successful outcomes.

To frame risk management as an unaffordable and optional cost is a false interpretation. Rather, it is a powerful instrument equipped to provide insights and craft strategies for navigating future uncertainties. The volatility of the current climate underscores the criticality of risk management, and disregarding it may trigger further problems for your organization.

Risk management is not a financial burden but a key component in the resolution of financial challenges. Businesses can ill-afford to overlook risk management. Instead of reducing their investment in risk management, organizations should embed it as a vital tool to steer through current uncertainties, solidifying their prospects for a brighter future.

Risk Register by ProjectBalm

Risk management is much more effective with a suitable tool. This is one reason we created Risk Register by ProjectBalm.

Our goal was to automate best practice risk management techniques, and do so via an elegant, usable interface that works with you, and not against you. Risk Register will help you to identify, analyse, treat and monitor risks more easily and effectively than ever before.

If you are experienced at risk management, you will find in Risk Register a tool that works the way you want it to work. If you are new to risk management, our documentation and videos will take you through the whole risk management process, giving lots of useful examples.

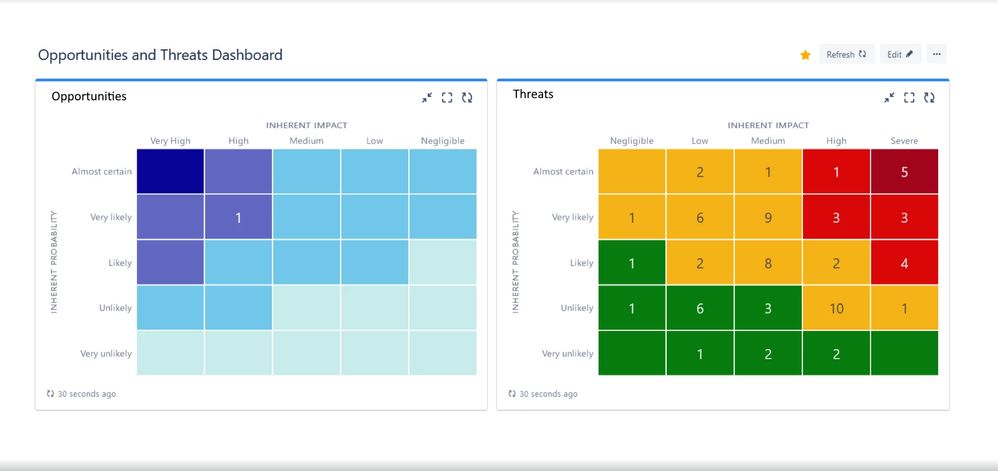

Risk Register is fully compatible with risk management standards such as ISO 31000, and can also be used for governance, risk, and compliance (GRC) programs such as Sarbanes-Oxley and PCI. And, of course, Risk Register allows you to easily distinguish between opportunities and threats.

Over the last few years, we've grown to become the most popular risk management solution in the Jira marketplace and we are now an Atlassian Platinum Partner. Why not try out Risk Register by ProjectBalm for yourself?

Was this helpful?

Thanks!

Craig Schwarze _ProjectBalm_

About this author

Founder at ProjectBalm

ProjectBalm

Sydney

8 accepted answers

Atlassian Community Events

- FAQ

- Community Guidelines

- About

- Privacy policy

- Notice at Collection

- Terms of use

- © 2024 Atlassian

1 comment