Community resources

Community resources

Community resources

Atlassian Marketplace: Category Leaders (June 2022)

MARS™

One of our unique offerings at Blended Perspectives is our Marketplace Analytic Research Service™ (MARS™) database of Atlassian Marketplace 3rd party apps.

At Blended Perspectives we pride ourselves on being a Solution Partner who does not make our own applications. Because of this customers and the Atlassian community as a whole can rely on us for objective, unbiased assessments of the Atlassian Marketplace. MARS™ is a key part of this. As a quantitative database covering every facet of the Atlassian Marketplace, MARS™ lets us combine our qualitative assessments of apps with the latest up to date information on a range of data driven metrics.

MARS™ contains a vast array of data from instances, reviews, and pricing, to platform, app growth, and version releases. This is all tied together at the top level through our meaningful app categorization in which, for every app over 500 instances, we carefully assigned our own categories based on the primary functionality of each app. We do this instead of using Marketplace app categorizations which are somewhat meaningless due to vendor self-selection. This means that MARS™ can give us a completely unique perspective into which apps are really excelling and driving forwards in the Marketplace.

MARS™ Categorizations

Our MARS™ categorizations are one of the main things that makes it such a unique and valuable service to both our customers and the Atlassian community as a whole.

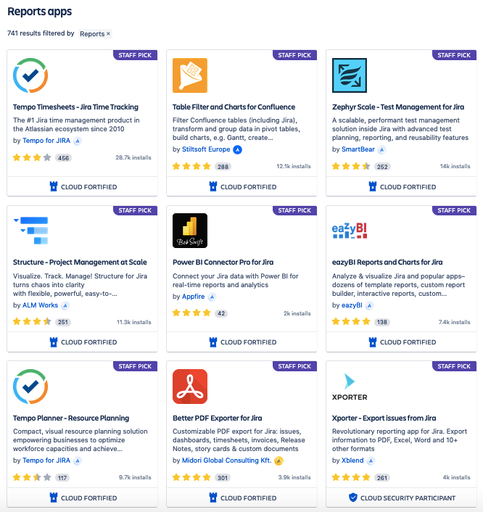

In the Atlassian Marketplace vendors self-select categories and, as we've noted before, these self-categorizations are not sufficient for Atlassian users looking to find applications to suit particular needs. This is because vendors (naturally) over-categorize their apps to fill as many search queries as possible. While this is understandable, as a customer looking for an app to suit a particular purpose can be difficult. Therefore, we have put a lot of effort into creating our own categories and assigning every 500 Club app to one.

Unlike Marketplace Categories, our categorization is based on primary functionality and utility. This means that when a customer wants to use MARS™ to find , say, a "Reporting" app they get apps that really are what they're looking for.

Figure 1: Atlassian Marketplace "Reports" Apps

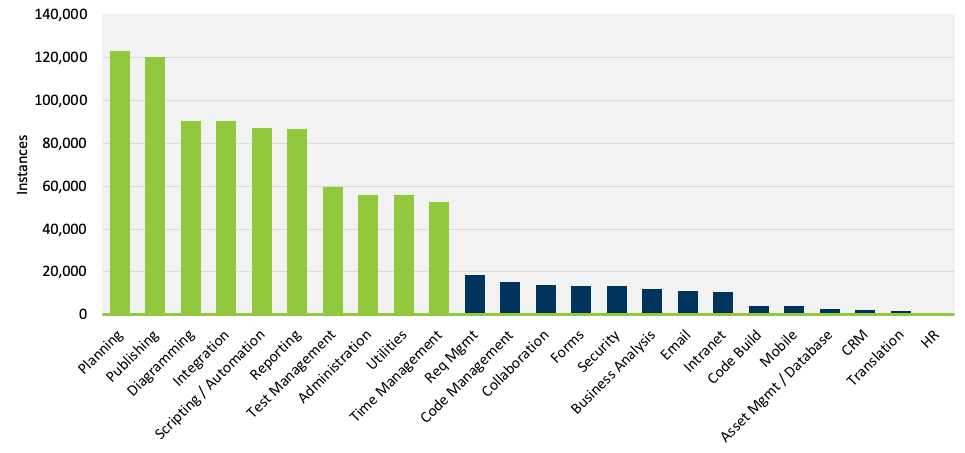

Figure 2: MARS™ Reporting Apps

If you have any questions or input around our categorizations then please feel free to reach out to us.

The Big 10

Out of our 23 MARS™ categories the 10 largest categories make up 87% of all instances. These 10 categories represent the main areas which Jira and Confluence users look to the Marketplace to extend the functionality of their products. Our report here will focus on those 10 categories.

Figure 3: The "Big 10" Categories

While we are mainly highlighting the "Big 10" Categories here it is worth noting that the others aren't "small" by any means. The 15,000 instances of the Intranet category is still a remarkably high number of customers, especially when you consider that an organization like ServiceNow only has 7,000 or so total customers. The scale in Figure 3 is just severely distorted by the sheer massiveness of the Big 10 Categories, in particular Planning and Publishing.

Fastest Growing Apps by Category (Over May, 2022)

Planning

Absolute Growth Winner

App: Project Management

Vendor: DevSamurai

May Absolute Growth: 367

Percentage Growth Winner

App: Gantt Chart Planner

Vendor: Ricksoft

May Percentage Growth: 28%

Publishing

Absolute Growth Winner

App: Aura Content Formatting Macros

Vendor: //SEIBERT/MEDIA - AppAnvil

May Absolute Growth: 191

Percentage Growth Winner

App: Aura Content Formatting Macros

Vendor: //SEIBERT/MEDIA - AppAnvil

May Percentage Growth: 13%

Diagramming

Absolute Growth Winner

App: draw.io Diagrams for Confluence

Vendor: //SEIBERT/MEDIA - Draw.io

May Absolute Growth: 2,025

Percentage Growth Winner

App: Graphity - Diagrams for Confluence

Vendor: yWorks

May Percentage Growth: 4%

Integration

Absolute Growth Winner

App: Power BI Connector for Jira

Vendor: Alpha Serve

May Absolute Growth: 359

Percentage Growth Winner

App: GitHub Links for Jira

Vendor: Move Work Forward

May Percentage Growth: 34%

Scripting/Automation

Absolute Growth Winner

App: ScriptRunner for Jira

Vendor: Adaptavist

May Absolute Growth: 133

Percentage Growth Winner

App: ScriptRunner for Confluence

Vendor: Adaptavist

May Percentage Growth: 3%

Reporting

Absolute Growth Winner

App: Rich Filters for Jira Dashboards

Vendor: Qotilabs

May Absolute Growth: 230

Percentage Growth Winner

App: Dashboard Hub for Jira

Vendor: Appfire

May Percentage Growth: 26%

Test Management

Absolute Growth Winner

App: Zephyr Scale - Test Management for Jira

Vendor: SmartBear

May Absolute Growth: 1,674

Percentage Growth Winner

App: AIO Tests (All-In-One Test Management for Jira)

Vendor: Navarambh Software Pvt. Ltd.

May Percentage Growth: 16%

Administration

Absolute Growth Winner

App: Deep Clone for Jira

Vendor: codefortynine GmbH

May Absolute Growth: 403

Percentage Growth Winner

App: Deep Clone for Jira

Vendor: codefortynine GmbH

May Percentage Growth: 8%

Utilities

Absolute Growth Winner

App: Issue Templates for Jira

Vendor: Deviniti

May Absolute Growth: 150

Percentage Growth Winner

App: Repeating Issues

Vendor: codedoers

May Percentage Growth: 6%

Time Management

Absolute Growth Winner

App: Timetracker - Time Tracking & Reporting

Vendor: Everit Kft.

May Absolute Growth: 64

Percentage Growth Winner

App: Timetracker - Time Tracking & Reporting

Vendor: Everit Kft.

May Percentage Growth: 3%

Congratulations to all of the apps and vendors who feature here as the growth leaders of their respective categories!

If you have any questions about MARS™ or any of our unique offerings then please touch with us at hello@blendedperspectives.com.

Was this helpful?

Thanks!

Joseph Law (Contegix)

Atlassian Community Events

- FAQ

- Community Guidelines

- About

- Privacy policy

- Notice at Collection

- Terms of use

- © 2024 Atlassian

4 comments