Community resources

Community resources

Community resources

Risk Management: What does a Risk Manager do?

In today's highly volatile and complex business environment, the need for managing and mitigating risk has grown more significant than ever. As a result, an increasing number of organizations are hiring risk managers to supervise the corporate response to risk. This critical role ensures a strategic approach to reducing the risks that organizations face, from cyber threats to economic fluctuations, legal liabilities, and beyond. The following article provides a comprehensive understanding of what a risk manager's role entails, defining its various facets and highlighting the importance of this position within any organization.

Implementing an Overall Risk Management Strategy

Risk managers are responsible for formulating and executing a comprehensive risk management strategy. This strategy includes understanding the company's objectives, recognizing the potential risks that could obstruct these goals, and developing action plans to counteract or mitigate those risks. Furthermore, it outlines how risks are specifically managed within individual projects, ensuring risks at both the macro and micro level are effectively addressed. The strategy also involves aligning the risk management process with the organization's overall business strategy, thereby ensuring a cohesive and comprehensive approach to risk mitigation.

Creating Risk Control Policies

One of the key roles of a risk manager is to create robust policies and procedures aimed at controlling and minimizing risks. This can include everything from operational and financial procedures to HR policies and business continuity plans. They are designed to anticipate potential problems, set standards for how to handle them and provide clear guidelines to all staff on how to avoid or respond to risk situations.

Identifying and Analyzing Organizational Threats

Risk identification, analysis, and recording are crucial activities for a risk manager. This involves understanding the organization's context and operations to identify all potential risks and threats, from financial and operational risks to strategic and reputational risks. After identification, these risks are then analyzed for their potential impact and likelihood. This critical information is then systematically recorded to facilitate continuous monitoring and management.

Preparing Risk Reports for Executive Management

Risk managers are also tasked with preparing detailed risk reports for the organization's executive management. These reports include an overview of the identified risks, their potential impact on the organization, the effectiveness of existing risk management measures, and recommendations for further action. Importantly, these reports also incorporate a summary of key risks stemming from various projects within the organization. This inclusion provides a comprehensive view of the risk landscape across all levels of the organization, from enterprise-wide strategic risks to project-specific operational risks. This information allows executives to make informed strategic decisions and ensures transparency and accountability in the risk management process.

Running Risk Workshops

Running risk workshops is another important function performed by risk managers. These workshops are designed to educate and engage various stakeholders, including staff members, executives, and sometimes even board members, about the organization's risk profile. They also serve to foster a collaborative environment where potential risks can be openly discussed and innovative solutions can be identified.

Building Risk Awareness with Staff

A well-informed workforce is a crucial line of defense against potential risks. Hence, risk managers play a critical role in building risk awareness through training activities. These activities aim to equip the staff with the necessary knowledge and skills to identify and respond effectively to risks in their day-to-day work.

Ensuring Risk Standard Compliance

Risk managers are responsible for ensuring that the organization complies with all relevant risk standards, regulations, and laws. This involves continuously monitoring the organization's operations, conducting internal audits, and working closely with various departments to ensure adherence to all applicable standards.

Controlling the Risk Management Budget

Risk managers have the responsibility of controlling the risk management budget. This budget includes funds allocated for risk mitigation strategies, insurance premiums, risk assessment tools, and training. They need to ensure that the budget is effectively used and offers a return on investment by reducing potential losses.

Implementing Risk Management Solutions

Finally, risk managers are responsible for proposing and executing risk management solutions. These solutions could include buying insurance, implementing new technology, changing operational processes, or even making strategic decisions. A significant part of this role also involves implementing a robust risk management system. Such a system serves as the backbone for all risk-related activities within the organization, facilitating risk identification, assessment, monitoring, and response. It could encompass the use of specific risk management software, application of analytical tools, or creation of a structured risk management framework.

Risk Register by ProjectBalm

An effective risk management system empowers the risk manager to perform their role proactively and systematically. This is one reason we created Risk Register by ProjectBalm.

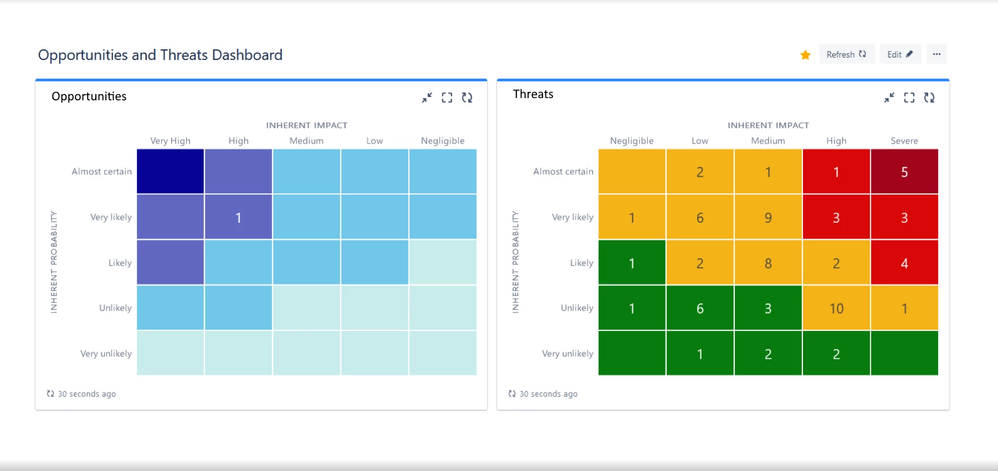

Our goal was to automate best practice risk management techniques, and do so via an elegant, usable interface that works with you, and not against you. Risk Register will help you to identify, analyse, treat and monitor risks more easily and effectively than ever before.

If you are experienced at risk management, you will find in Risk Register a tool that works the way you want it to work. If you are new to risk management, our documentation and videos will take you through the whole risk management process, giving lots of useful examples.

Risk Register is fully compatible with risk management standards such as ISO 31000, and can also be used for governance, risk, and compliance (GRC) programs such as Sarbanes-Oxley and PCI. And, of course, Risk Register allows you to easily distinguish between opportunities and threats.

Over the last few years, we've grown to become the most popular risk management solution in the Jira marketplace and we are now an Atlassian Platinum Partner. Why not try out Risk Register by ProjectBalm for yourself?

Was this helpful?

Thanks!

Craig Schwarze _ProjectBalm_

About this author

Founder at ProjectBalm

ProjectBalm

Sydney

8 accepted answers

Atlassian Community Events

- FAQ

- Community Guidelines

- About

- Privacy policy

- Notice at Collection

- Terms of use

- © 2025 Atlassian

0 comments