Community resources

Community resources

- Community

- Products

- Jira Align

- Articles

- Rightsizing Your Change Portfolio With Jira Align

Rightsizing Your Change Portfolio With Jira Align

Introduction

A valued Atlassian customer once asked: “how many programs per portfolio are too many? Is there a recommended best practice?” The short answer is, yes there is, but obviously this is quite subjective.

Size does matter! Rightsizing questions have always lingered whether we're discussing modern agile teams adopting lean portfolio practices or traditional project-based teams using PPM practices. Sometimes, we see organizations taking extreme positions.

There is nothing right or wrong in these contextual views. These tend to be subjective choices depending on various organizational and investment considerations. It is also common for companies to be constrained in their approach by budgets, capacity, timing etc. But creating guardrails instead of hard constraints allows for self-regulation. They can result in a journey towards optimized portfolio design. This is otherwise known as investment agility. A lean portfolio practice helps us get there.

This article outlines 4 key considerations often overlooked by organizations in their early stages of LPM evolution.

1. Pre-Condition: Leadership fostering Investment Agility

We’d need executive leaders to set out clear strategy and policies across the enterprise on what to centralize vs what to decentralize when it comes to investments. This is an obvious and essential precondition, but commonly missed. This underscores why requiring C-Level participation is non-negotiable for agility.

What to typically centralize across an enterprise

In short, enterprise change strategy & investment policies are better centralized to ensure visible, coherent and consistent alignment of changes to the overall company strategy. |

What to typically decentralize across an enterprise

In short, the investment driven change lifecycle management is better decentralized to promote healthy autonomy in the organization, reducing barriers and fostering investment agility. |

|

How Jira Align can support with centralizing Jira Align’s Strategy Room along with below supporting views helps with centralized change strategy and investment policies/guardrails for the enterprise:

|

How Jira Align can support with decentralizing Jira Align’s Portfolio Room along with below views helps decentralizing investment driven change lifecycle to the respective portfolio (and program) teams:

|

|

|

Jira Align sets the stage for balancing alignment with autonomy, resulting in healthy collaboration and shared purpose across the org. With the right investment policies and guardrails, we can set a key precondition for a natural self-regulation of a portfolio of investments.

2. Balancing Investment Risk vs Reward

Let’s not overlook that portfolios are fundamentally investment vehicles that exist for the purpose of maximizing value (ROI) and minimizing financial and delivery risk. Thus, once we establish the portfolio vision, boundaries and outcomes, we need a way to see if the work intended actually realizes the anticipated value with manageable risks.

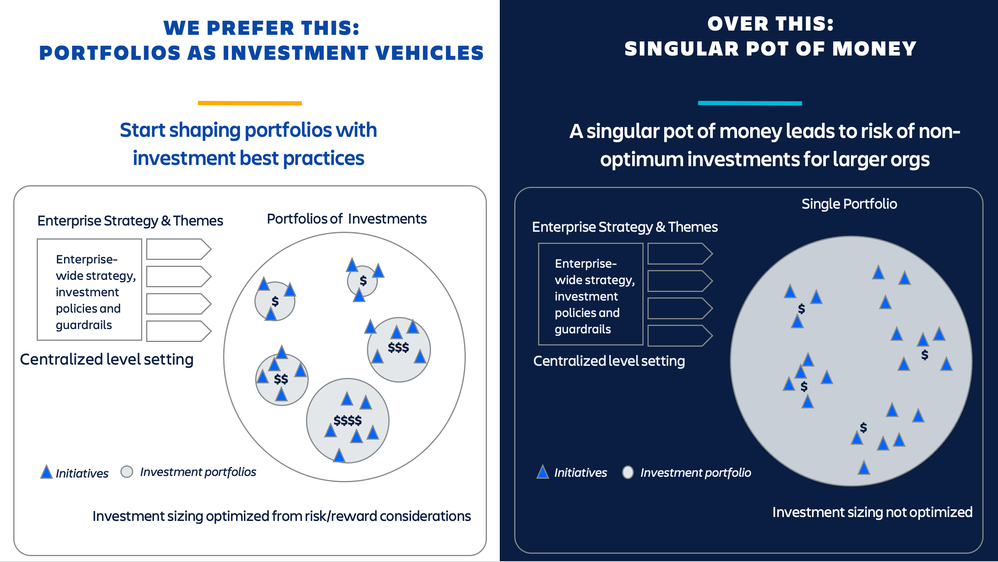

For a large/medium enterprise, monolithic portfolios (due to their collective investment size) usually suffer from higher investment risks compared with smaller and diverse portfolios that help with “spreading the eggs in different baskets”. Exceptionally, smaller orgs may need just one portfolio for the sake of simplicity.

LPM advocates for continually taking an economic view of intended benefits via inspect & adapt loops, paving way for pivot/persevere decisions. But the fine print is that we can as well evolve/rightsize the level of investment based on how we choose to experiment.

Jira Align’s budget and forecasted, estimated and accepted spends provide such ‘point in time’ visibility of investment vs spend. This along with OKRs and value engineering / hypothesis driven development arm organizations to pivot/persevere with visibility and confidence.

3. People and Teaming Considerations

A Portfolio (other than being a collection of investments) is also a collection of teams that delivers value.

A typical mistake that many orgs do is viewing portfolio as a governance function. A portfolio is more than a "program office" in principle. A portfolio usually comprises of various types of teams that work together: governance teams (VMO, APMO etc), portfolio leadership teams (strategy, sponsorship, servant leadership), collection of agile delivery teams (any agile teaming structure such as value streams, team of teams, ARTs etc), operational excellence teams (CoEs, LACE, coaching, enablement, ways of working teams etc).

Obviously, healthy teams perform better and co-create value better. Hence, it is important to closely understand the attributes of team health such as cohesion, morale, psychological safety etc. The reason to call this out is that the sizing also depends on the cognitive load on these types of teams. As teams multiply, the demand for collaboration goes higher putting pressure on the team collaboration. Hence, this is an important consideration for optimizing and sustaining high performance.

Staff morale, happiness, psychological safety, cognitive load etc tend to be qualitative measures that are usually captured in form of pulse surveys. Irrespective of how data is collated, such data can be brought together with agile measurements from Jira Align using Enterprise Insights / Atlassian Analytics for a better view of team mental health.

4. Optimizing Flow of Value

Many traditional work environments are commonly conditioned to believe assumption driven ROI. The only opportunity to find out the real ROI comes after the delivery. But with a lean approach we can measure the value generated at every stage on it's way to the end customer.

LPM advocates funding long-lived agile teaming structures (typically value streams) for better flow of value. Quoting the original measurements from the Toyota Production System or TPS that help optimize flow of value:

-

Safety (psychological safety in the knowledge industry)

-

Morale (staff morale and happiness)

-

Time (cycle time/lead time/activity ratios etc)

-

Flow (flow metrics)

-

Quality (your internal QA indicators)

-

Cost (capacity and economic views: forecasts, spends, FTE, ROI etc.)

Notably all these are lag indicators and tend to be adapted within each org context. These are great for optimization, rightsizing or self-regulating. The lead indicators (such as OKRs) are great for alignment and aspiration.

Jira Align and Enterprise Insights accelerate visualizing and embedding customized measures into the practice resulting impactful alignment and self-regulation. Here is a related community post about flow metrics

Conclusion

The above are introductory, but key LPM considerations. Atlassian Advisory Services offer workshop engagements on “Portfolio Fundamentals” and “Expand to Portfolio” to enable organizations to discover, design and evolve lean portfolio management practices using Jira Align. If you have deeper interest in LPM or considering an LPM implementation in your organization these engagements can be very beneficial.

Was this helpful?

Thanks!

Ranjan Rao

About this author

Sr Enterprise Solution Strategist | Enterprise Agility

Atlassian

United Kingdom

Atlassian Community Events

- FAQ

- Community Guidelines

- About

- Privacy policy

- Notice at Collection

- Terms of use

- © 2024 Atlassian

0 comments